Mental Gymnastics

Recently a glaciologist who’s well known among those who follow climate science and melting glaciers made two videos essentially saying that purchasing bitcoin can save us from climate change.

I’m not joking.

I won’t name him because this isn’t about him specifically, but rather about the amazing feats of mental gymnastics humans participate in to confirm our biases.

At first I thought his video was satire. But then I asked on X (formerly Twitter) and he confirmed. And then he made a second video doubling down on his assertion.

The main points of his thesis are as follows (as far as I can understand, anyway):

War wastes energy.

War is financed by fiat money (see definition below).

Bitcoin is “hard money” and when you’re on a “hard money” (see definition below) standard, war is exposed as wasteful.

Using bitcoin will therefore reduce war.

Reducing war will reduce carbon emissions from war.

This will give societies a chance to engage in climate more, and destroy less; we won’t “waste” assets (energy, materials, etc.) on war.

Bitcoin is “negentropic” (see definition below).

Bitcoin uses more than 2/3 of the renewable energy on the planet.

Bitcoin mining is only economical when energy, and renewable energy specifically, is cheap and demand is low.

Bitcoin doesn’t use energy under high demand; it uses energy when there’s lots of energy on the grid.

By buying electricity when the sun is shining and the wind is blowing, when demand is low and energy is cheap, bitcoin investors are financing the roll out of more renewable energy.

Wasted energy, like methane flaring and landfill gas, can be used to create value through bitcoin mining.

Bitcoin is therefore “a technology for peace.” (Again, I’m not joking—he actually says this.)

I’ll be the first to admit I know almost nothing about finance and currencies. But as little as I know, I know that this is insane.

Let’s begin by looking at some definitions. When discussing currency, usually we speak of “fiat currency”—currency backed by public faith in the issuer—and “commodity currency”—currency based in a physical material like gold, silver, or oil.

Throughout the video, the glaciologist refers to “hard currency” and “hard money.” I looked up the definition of “hard currency” and it is: “a globally traded currency that is considered stable and reliable, and is not likely to lose its value. Hard currencies are issued by governments of developed countries with strong economies and central banks.”

However, I think by “hard currency” and “hard money” he actually means “commodity currency.” At least that’s the impression I get from the videos. I’m going to assume that’s how he’s using the term (I could be wrong).

Gold is an example of a commodity currency. We humans used gold coins as currency when gold was fairly easy to come by. Then we replaced gold coins with other kinds of coins and eventually paper money whose value was tied to the price of gold through the financial system. This was called the gold standard. It took a lot of energy to mine gold, and gold was (and still is) scarce. This makes gold standard currency a commodity currency, or “hard money” as the glaciologist calls it.

In the 20th century, the world-moved away from the gold standard to fiat currency, meaning money is no longer tied to a physical asset directly; rather its value is derived from the trust people have in the government that issues it, not from any physical commodity like gold or silver. Essentially, money is considered valuable because the government says it is, and people widely accept it as a medium of exchange.

It’s certainly true that unlike the gold standard, with fiat currency, it’s easy for governments to print more money without having any (or many) requirements to back up that money with physical assets. However, fiat currency is still tied indirectly to physical assets. The U.S. dollar is the currency used for global oil trade. That means countries must hold U.S. dollars to buy oil. U.S. dollars are no longer “gold dollars;” they are “oil dollars,” also known as “petrodollars.” So fiat currency isn’t exactly commodity-free. I’ll let you explore the connection between currency and oil in this article by Investopedia, but it’s likely obvious to everyone that “oil is the backbone of industrial civilization” and this is reflected in our fiat currency (the price of oil greatly impacts the value of currency around the world).

Throughout his second video, the glaciologist claims that by moving back to “hard currency” that is directly tied to a commodity, we will “defund war” because war is incredibly wasteful (of energy, resources, time, people’s lives, etc.) and that this waste will be far more obvious with a hard currency than with fiat currency.

He claims bitcoin is a “hard currency.”

This might seem odd at first, given the digital nature of bitcoin (and how easy it is to lose bitcoin permanently if you forget the password to your bitcoin wallet!). So why is bitcoin a hard—or commodity—currency? Because, unlike fiat currency, you can’t just “print” more bitcoin. More like gold, you must mine bitcoin, and bitcoin is difficult and energy intensive to mine. Bitcoin isn’t “mined” in the traditional sense of pulling materials from the Earth that can be directly traded for other materials or made into products that can be purchased; instead it is computed via algorithms running on huge numbers of computers. But those computers are made with materials mined from the Earth, like silicon, gold, silver, copper, palladium, and more, in massive data centers running on electricity supplied by coal, gas, hydro, solar and wind power plants, batteries, and so on. Solar and wind power plants and battery energy storage systems in particular are technologies that require large amounts of materials to convert the sun and wind into storable electricity, adding to the materials and energy load of bitcoin.

We can therefore think of bitcoin as a proxy for the energy used directly to run the algorithms that “mine” the bitcoins, and indirectly for the materials and energy to mine these materials and build “renewables” and grid lines and batteries and dams and nuclear power plants and data centers and computers and cooling systems and so on. That is the energy and hard materials bitcoin represents, similar to how the gold standard represented the energy and materials it took to mine, process, and turn gold into gold coins (or blocks of gold sitting in a vault somewhere as a backup for gold standard paper money).

Bitcoin value propositions

As I said, I know virtually nothing about finance. The glaciologist claims that a commodity currency like bitcoin will expose the wastefulness of war more than the fiat currency of the petrodollar does. Maybe it will (or would, if it was to replace fiat currency); I don’t really know.

Given my ignorance of finance and currencies, I will focus on the value propositions the glaciologist claims for bitcoin.

Store of Value

The first of these is that bitcoin’s value is in its “store of value.” He says “You can put your economic energy—your time—into storage and you can recover your work time at a point in the future and teleport it in space” and that “money is an expression of your energy and time.”

We aren’t just putting our time and energy into making bitcoin. As the glaciologist takes great pains to elucidate in his video, bitcoin is a “hard currency,” meaning it’s tied to material resources—the electricity required to run the computers to “mine” the bitcoin, and the materials and energy required to supply that electricity. This is the Earth’s time, energy, materials, and natural communities, too.

He uses the term “renewable energy” as if that energy is somehow better than, or less materialized than energy from fossil fuels. But we know that’s not true.

Where I live, cryptocurrency data centers are located near huge dams on the major rivers of the Pacific Northwest. These dams have all but eradicated the wild salmon runs. Destroying the salmon runs then damages the forests, and all the living beings who depend on the salmon. The reservoirs annihilate large biodiverse habitats, particularly rich along river valleys, and spew out methane as the now-covered biomass from the valleys decomposes slowly under water. The dams gather silt that would otherwise flow down the river enriching riparian areas and eventually the estuaries at the mouths of these rivers, which are now entirely deprived of these nutrients, thus depriving other species of the same. The silt shortens the lifespan of dams. Hydropower is far from “renewable,” is incredibly damaging to the environment, and is in no way better than fossil fuels. It’s just different.

Wind turbines are also a growing source of electricity for cryptocurrency data centers in the Pacific Northwest. These turbines require huge amounts of steel, concrete, plastic, copper, rare earth metals, and other materials to make. They are installed on ridge lines, where trees are cleared, fragmenting and destroying habitat and displacing many wild beings who would otherwise use this habitat. Wind turbines are great killers of large raptors, including bald and golden eagles, hawks, and falcons, and bats whose lungs explode when they fly too close to turbines, if they aren’t killed outright by the blades. Again, no better than fossil fuels, just different.

In fact both of these technologies, along with solar panels, batteries, etc. are just fossil fuels embodied in the materials required to make them. I’ll return to this point a bit later.

So, bitcoin isn’t just a representation of “our energy and time;” it is also a representation of the destruction of the natural world at massive scale. There is no way to get that energy back, or undo that destruction. When you sell a bitcoin to “recover your work time” as the glaciologist says, you don’t suddenly undam the rivers, or undig the materials to make “renewable” technologies, or undo the habitat destruction to install them, or unkill the salmon, lamprey, eagles, hawks, falcons, and bats killed by those technologies.

The glaciologist claims that “You can put your economic energy—your time—into storage and you can recover your work time at a point in the future.” This completely ignores that it’s just my “work time” that is “recovered” (if one is willing to equate time and money, which is something not all of us accept). The harms to the natural world can never be recovered. Those are permanent.

Renewable Energy

Another value proposition the glaciologist claims is that because bitcoin uses more than 2/3 of the renewable energy on the planet, by buying bitcoin, investors are financing the roll out of this so-called “renewable energy.”

This claim is based on the premise that rolling out renewable energy—actually, rebuildable technologies—is a good thing.

This is false for two reasons: first, because of all the harms caused by these technologies, some of which I described above.

Second, it is false because we know that new “renewable” energy is not replacing fossil fuels (York et al, 2019). For the most part, more energy yields more growth and development, which then requires more energy to maintain.

Bitcoin exemplifies this rather well. We’re using 2/3 of renewable energy to run algorithms on computers in large data centers, rather than to replace fossil fuels for things like heating homes, running existing computers used for other tasks, or for manufacturing industries. Is this not an obvious flaw in his argument? The more people buy bitcoin, the more computers and data centers we must build and the more energy it then requires to maintain (and, eventually replace) those things along with the energy it takes to run the computers to “mine” the bitcoins. In this way, renewable energy actually contributes to climate change (along with many other ecological impacts).

A Technology for Peace

The glaciologist claims that because bitcoin is auditable, it won’t be used by criminals and terrorists. He claims that bitcoin is a “technology for peace” because it separates money and state.

I’ll respond to this claim with two quotes from eucrim, a source of articles about criminal activity in the EU:

“Terrorist organizations employ cryptocurrencies to create venture capital and obtain higher funding.”

“Cryptocurrencies have emerged as a novel method for criminals to finance a wide range of illicit activities, including terrorist fundraising beyond national boundaries. Evidence indicates that certain terrorist organizations are utilizing cryptocurrencies as a means to raise funds.”

— Prospects and Models of Combating Cryptocurrency Crimes

Dematerialization

He says the majority of people lack access to financial services, but now that mobile phones are ubiquitous, these “unbanked” people can have a digital “bank in their pocket.” He claims that mobile phones have “dematerialized” record players, cds, books, scanners, and more into cyberspace, and that banks are likewise being dematerialized into our pockets via cryptocurrencies.

But this dematerialization is a fantasy. There are the materials in the phones, and the waste created by the phones. Most of the materials that are used in making phones are never recovered. There is the energy required to power those phones, energy from coal-fired power plants or solar panels or dams, and the materials to make those things. There are the physical wires that carry the electricity to charge the phones and carry the data on the internet. There are the massive data centers holding the digital representations of those record players, cds, books, and scanners on physical hard drives in physical computers cooled by physical air conditioners. The “dematerialized” banks are completely reliant on employees that are required to run the banks, employees who live in physical houses, use physical cars, and eat real food. The banks are completely reliant on the data centers used to hold all their banking data, along with the computers running the cryptocurrency algorithms, and the energy systems to power them, and as we saw earlier, these are anything but “dematerialized.”

In fact, by saying the banks are “dematerialized,” the glaciologist is contradicting himself because of his claim that bitcoin is “hard money.” It’s only “hard money” if it represents the very real and very physical materials and energy that’s required to “mine” those bitcoins for the cryptocurrency used by these “dematerialized” banks.

He can’t have it both ways.

Negentropy

He claims that bitcoin is “thermodynamically sound” because it “creates order from chaos.” It is “negentropic;” that is, it takes energy and converts it into an ordered system—the bitcoin—via an algorithm running on a computer.

On the whole, we experience the world as entropic—creating chaos from order. You drop an egg, it breaks, and you can’t put it back together. You burn wood, and it creates heat that you can’t ever get back as wood or anything else once it is dissipated.

He claims that “You can reverse time locally at the expense of the surroundings by a negentropic process.”

To go in the reverse direction—to make order from chaos, “reversing time locally”—requires a huge amount of energy—this is the “at the expense of the surroundings” bit. We can take energy to turn iron ore, coal, and nickel into steel to make wind turbines to generate electricity, but it requires a lot of heat and materials that must be mined from the Earth, and we can never get back the ecosystems destroyed in the process, at least not on human timescales. Most of the materials we pour into making solar panels, wind turbines, dams, computers, data centers, air conditioning systems, and so on, we never get back either.

War

He claims this energy to create “negentropic” bitcoins is “worth it” because it will expose the wastefulness of things like war that do great damage to the natural world and to the climate it. But is it?

War is absolutely terrible. But so is destroying the environment to build dams and solar panels and wind turbines and coal mines and nickel mines and lithium mines and computers and data centers. Many of us view this destruction as a “war on nature.” So are we simply adding one kind of war to another?

What he also seems to ignore here is that “renewables”—rebuildable technologies—require massive amounts of fossil fuels (you can’t mine mountains of copper without copious amounts of diesel; you can’t manufacture steel and silicon without copious amounts of coal). Powering bitcoin with “renewables” and thus financing the roll out of more renewables is simply financing fossil fuels that are once removed, hidden by the intermediaries of materials and technologies.

What do countries go to war over?

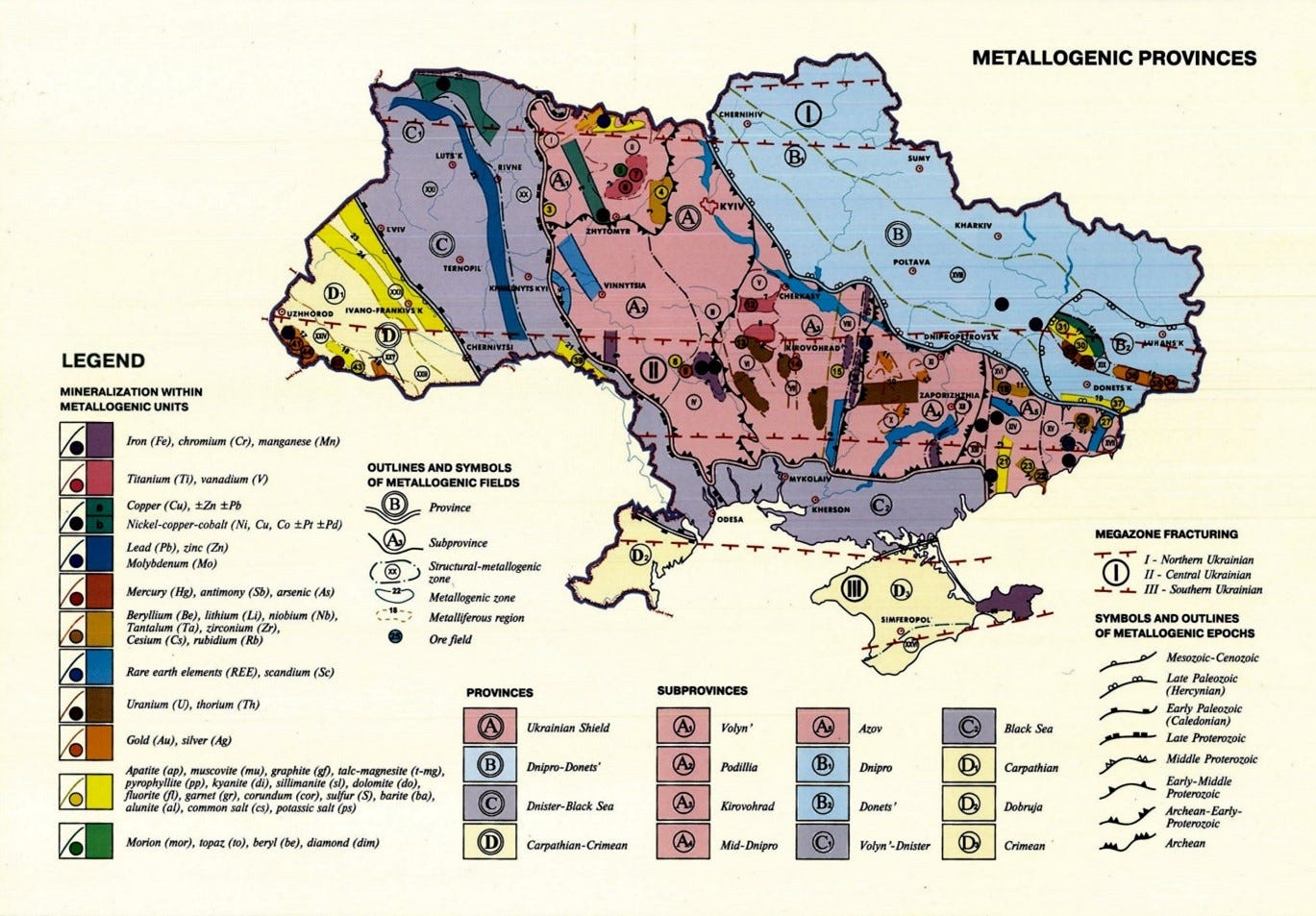

Countries go to war over resources like metals and minerals and the land they are embedded in. (Why do you think Russia invaded Ukraine? Among other reasons, because Ukraine is sitting on a hell of a lot of metals and minerals.)

When the non-renewable, finite materials required to build the “renewable” technologies and computers to power the bitcoin algorithms run out, what do we think will happen?

Countries will go to war over those materials. So, have we stopped war with bitcoin? No, we just added a new reason to go to war: along with conflicts over oil, coal, and gas we add conflicts over lithium, copper, and nickel.

The glaciologist says: “Societies need energy” and that “The prosperity of a nation depends on its ability to harness energy.” This “need” is how he rationalizes technologies like bitcoin and so-called “renewables.”

The prosperity he is talking about is the prosperity of wealthy humans. Prosperity like gold. Prosperity like the materials to build “renewables” and computers. Prosperity like oil, coal, and gas.

He’s right; this kind of prosperity is utterly dependent on energy, and that energy is utterly destroying the natural world. But the only energy humans actually need is the energy we get from the sun—the solar energy that grows plants which are then eaten by other animals which are then eaten by human mammals. That’s it. All other energy is energy we want, rather than need. Are we willing to keep destroying the living planet for it?

If your answer to climate change is to shift currencies to bitcoin, then your answer is “Yes; we will keep destroying the living planet to get the energy we want.” We know where that path ends.

And what about prosperity for non-humans? For natural communities? For ecosystems? Again, the glaciologist contradicts himself. He claims to care about the ecosystems destroyed by war, but he doesn’t seem to care in the slightest about the ecosystems destroyed by mining, by dams, by data centers, or by the things we do and build with all those bitcoins.

The Human Supremacy of Bitcoin

The claim that bitcoin will end war and save the climate is, as I hope is clear, a prime example of human supremacy.

What’s human supremacy? It’s an ideology that humans are somehow worth more than the natural world. That we are at the top of some imagined pyramid of value, and that nature is here for us, rather than here with us.

It is an ideology that blinds people to the reality that climate change is just one of many symptoms of the real problem of ecological overshoot and that all our technology “solutions” for climate change will just make that overshoot worse.

It is an ideology that causes otherwise smart people to convince themselves of lies. Along with those human supremacists who believe in infinite economic growth and who believe that fossil fuels are “black gold” as Donald Trump called them, and “god’s gift to humans” as the President of Azerbaijan recently stated at COP29, it includes people who think we should mine, mine, and mine some more for “critical” materials like lithium, copper, iron ore, nickel, and more; who think we should use those materials to build wind turbines and solar panels and EVs and new grid lines and batteries galore in a bid to prevent climate change; who believe throwing nature under the bus in the name of carbon emissions is “worth it.” It includes people who think that it’s okay to log this forest over here, as long as we plant trees over there and call it “carbon credits;” and who think AI will somehow come up with a solution to climate change and therefore building more data centers to run incredibly energy intensive AI computations is worth it. And it includes people who think bitcoin is a “technology for peace” and will “end war.”

These are all the fantasies of human supremacists.

Somehow, in his desperate concern about climate change—which I can relate to, don’t get me wrong—the glaciologist has convinced himself that this fantasy is real. And so we see a transformation from a dedicated researcher concerned about climate change into someone who is trying to convince people to buy bitcoin.

As ecological overshoot worsens, and with it, the many environmental crises we face, like habitat loss, species loss, pollution, and yes, climate change, people will get more and more desperate. We can expect to hear many more fantasies as a result.

Let’s hope some remain grounded in reality: the natural world is primary, and our task now is to defend it with our lives.

Hard currency prevents war?

World War II and all prior wars were fought under hard (commodity) currency regimes. (World Wars I and II were fought under the gold standard. Nixon closed the gold window in '71.)

The Enlightenment dream—that man's "reason" will prevent costly war—drowned in the river Somme, in 1916.

Agree with most of this, Governments collect tax so this secures them. If they didn’t have intermediaries gouging the public issuing currency direct shouldn’t be a problem.

The over complicating of the system, prejudice and bias (some get access others don’t, particularly women….time is money and labour is money again for some, not others)have twisted this simple process entirely out of shape.

A reform should simplify (cash and privacy is important and protective as is faith in the system for social license all of which is gone arguably.

Over thinking and replicating a poor system not simplifying, is a very poor plan.

Good to see people thinking and talking about this fundamental in the suite of problems and perversions.